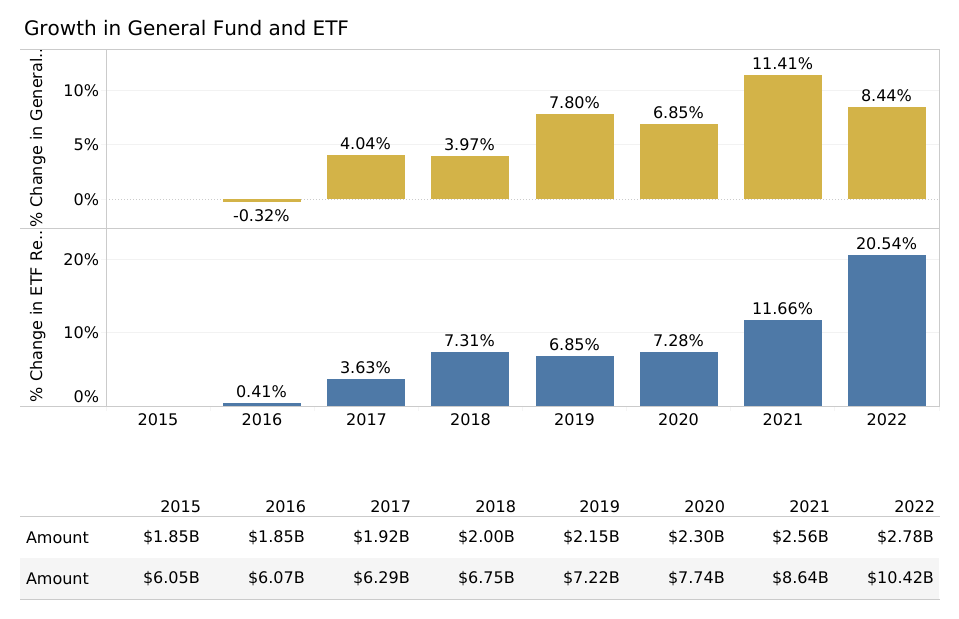

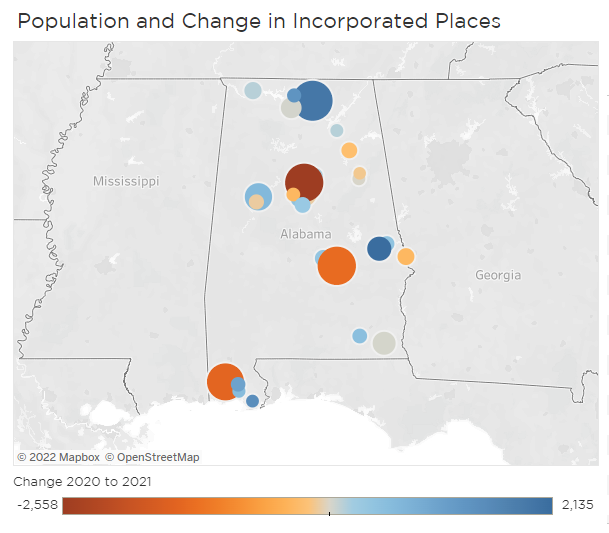

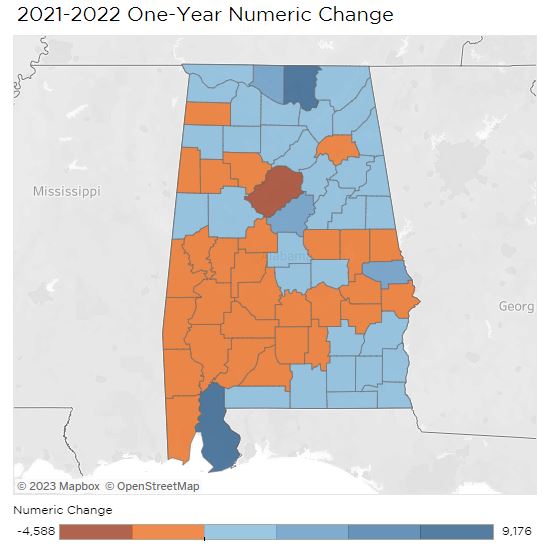

People are moving to Alabama, and according to most recent population estimates, the growth is more widespread than it has been. Out of 67 counties, 36 saw population growth between July 1, 2021, and July 1, 2022, the period covered in the latest Census Bureau release. In the prior year, only 29 counties saw positive growth. Throughout the 2010s, only 24 counties grew.

Fig. 1. Numeric Change 2021-2022

The growth is particularly noteworthy because four factors were putting downward pressure on population growth:

- Death rates were still elevated in the wake of the Covid-19 pandemic

- The large Baby Boom generation is entering years of increased mortality

- Smaller succeeding generations have lower birthrates

- International immigration is still lower than historical norms

But in the counties that grew, and for the state as a whole, domestic migration — a net positive number of U.S. residents moving into the state — overcame the headwinds.

Fig. 2 Domestic Migration 2021-2022

The strongest growth was among the usual suspects: Baldwin County in the south and Madison and Limestone counties in the north, with Lee, Shelby, and Tuscaloosa counties also continuing positive growth trends. The Huntsville area’s growth continues to spread across North Alabama, with population growth accelerating in The Shoals (Lauderdale and Colbert), Cullman, Morgan, and Marshall counties.

The Wiregrass and Northeast Alabama counties also grew, including Calhoun County, which had been on an extended population losing streak. Calhoun added over 600 new residents through domestic migration for a net population gain of 111. Etowah County attracted 524 new residents, but since deaths exceeded births, the population total declined slightly, down just 55 residents.

In percentage terms, Limestone County grew the fastest. That’s likely growth not only in Athens, the county seat, but also from Huntsville and Madison, which have spread from Madison County into Limestone. Generally, counties along the Interstate corridors are growing, as well as counties bordering Tennessee, Georgia, and Florida. On the western border with Mississippi, most counties are losing population.

Urban losses

Alabama’s traditional urban centers — Jefferson, Montgomery, and Mobile — lost population, primarily due to domestic outmigration.

That population loss parallels national trends among urban counties: in the wake of the pandemic, most population centers lost population. According to the estimates, Jefferson County’s population decreased 4,588 in 2022. Since the 2020 Census, Jefferson County’s population has decreased by almost 9,000.

Rate of Domestic Migration, 2021-2022

There are signs of a turnaround, though. Nationally, large urban centers began seeing population recovery in 2022. Jefferson County’s population loss was lower in 2022 than in 2021. International immigration and natural increase helped fuel population growth in urban centers elsewhere, including among Southern neighbors. Alabama’s big cities saw some population growth through international immigration. However, Alabama generally sees much lower rates of international in-migration.

Rate of International Migration, 2021-2022

Divergent Rates of Change

Alabama’s Black Belt and other more remote rural counties continued to lose population through residents moving away and through higher death rates. According to the estimates, Lowndes, Perry, and Greene Counties are each now below 10,000 in population, with Greene being the least populous at 7,422. Bullock, Coosa, and Wilcox are close to 10,000. Nationally, about 1,000 of the more than 3,000 counties in the U.S. have 10,000 or fewer residents.

Population Estimates, 2022, U.S. Census Bureau

In addition to outmigration, rural counties tend to have negative rates of natural change: in other words, more deaths than births. Those counties tend to have a higher median age, with a higher share of the population over 60. That’s a population that has an increased risk of death from natural causes.

Rate of Death, 2021-2021

On the opposite end of the spectrum are counties with a higher proportion of the population who are young adults or in their child-bearing years. In only eight counties have births outnumbered deaths since 2020: Lee, Shelby, Madison, Montgomery, Tuscaloosa, Limestone, Marshall, and Autauga.

Rate of Natural Increase, 2021-2022

The tabs above the images allow you to explore statistics for individual counties for births and deaths, and domestic and international migration, as well as numeric change over time.

The National Picture

Alabama’s population change is occurring in the context of national trends that are visible when zoomed out to the national level. Population losses in Alabama’s Black Belt are connected to patterns along the Mississippi River from Mississippi and Louisiana, Arkansas, Missouri, and even Illinois. Baldwin County’s growth rate has echoes along the coasts of Florida, Georgia, and North and South Carolina coasts. Huntsville’s growth sits at the edge of the mountain interior southern region stretching across Tennessee, North and South Carolina, and Northern and Central Georgia.