Despite the wild gyrations in the economy since the outbreak of COVID-19 in the spring of 2020, the latest comparative data from the U.S. Census Bureau finds Alabama in a familiar position: at or near the bottom in state and local government tax collections.

Key Findings

• Alabama is a low-tax state: In FY 2021, adjusted for population, Alabama collected less in state and local taxes than all but one other state. Alaska, thanks to disruptions in the oil market over the period, had the lowest per capita revenues.

• Alabama’s per capita property tax collections are the lowest in the nation. That helps owners of homes, farms, and timberland but creates a revenue deficit, leaving state and local governments with less to spend to provide government services such as education, health, and public safety.

• Alabama’s state and local sales tax rates are among the highest in the U.S., which compensate for low property taxes.

• Alabama’s income tax does not provide the balancing effect that income taxes in other states do. Low-income workers begin paying taxes at a lower threshold than any other state. At the other end of the spectrum, Alabama is the only state that allows a full deduction for federal income taxes paid, a tax break that benefits high-income earners.

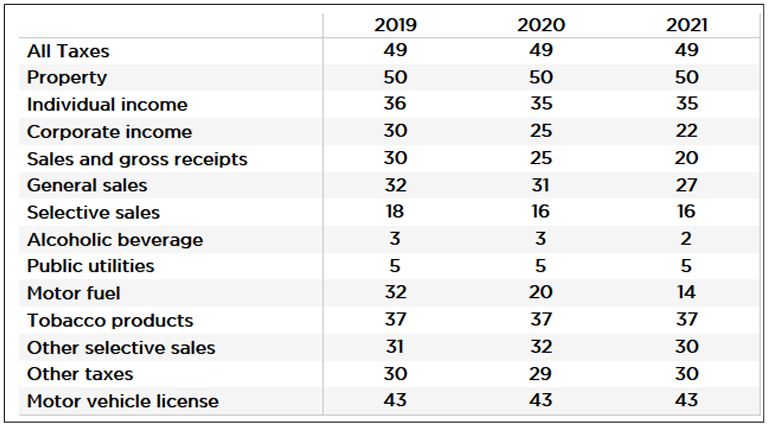

Despite unusual circumstances, Alabama’s rankings in per capita state and local tax collections were generally consistent with rankings in prior years.

Motor fuel collections per capita jumped in rank because half of Alabama’s fiscal year was pre-pandemic at a time when the economy was booming and gas prices high. In contrast, most states’ fiscal years began in the months after the pandemic began. Gas prices plummeted, and the total miles traveled on American roads didn’t recover until the calendar year 2022.

Alabama’s sales and gross receipts were also elevated thanks to the state’s high sales tax rate, the elevated volume of pandemic-related buying, and the economic stimulus payments that accelerated spending beginning in April 2020.

Despite all that, Alabama continues to lag behind almost all other states in total per capita collections.

Table 1. Alabama Rank in Per Capita Tax Collections, 2019, 2020, 2021.

In the years since FY 2021, tax revenues have surged based on the infusion of federal stimulus, low unemployment, and high inflation. Legislators have responded by making needed investments, particularly in education, in the form of teacher pay raises and a surge of additional support for literacy and math instruction.

At the same time, the Legislature has also passed tax cuts. In 2022, it increased the standard deduction for low-income Alabamians, allowing more households to shield more of their earned income from the income tax. In 2023, the state sales tax on food items was reduced from 4% to 3%, with a further 1% reduction scheduled for 2024 if revenue targets are met. These targeted tax cuts are a fitting response at a time when inflation is elevated, 3 with state tax collections surging to historic highs and federal COVID-19 relief funds swelling government accounts.

Flush times could allow Alabama to address years of chronic underinvestment compared to other states. Unacceptable conditions, such as understaffed and crumbling prisons, persist. Investments in education that show positive results must be sustained. However, as growth slows and federal aid is exhausted, Alabama governments will likely return to a familiar position of having less money to spend and yet a greater need for government services.

PARCA’s interactive charts allow you to explore a variety of statistics regarding Alabama’s taxes and tax revenue in comparison to other states. For the entire analysis, see our complete report in a printable version. Or read an embedded copy of the report below.